Not adding up

College costs keep climbing

As school comes back into session and seniors apply for college, families and students revisit the cost of a college education. Tuition has increased for decades, and more than 44 million Americans have student loan debt according to Business Insider. Students and their families have many resources, however, to help them tackle this problem, from 529 college savings plans to school counselors.

Student loan debt is not a problem that only families and students should be worried about, because this kind of debt in large amounts can impact the economy as a whole. While graduates pay off loans, they will not spend that money elsewhere . “Recent graduates with college debt are less likely to buy houses, cars and get married,” Dr. Megan Healy, Chief Workforce Development Advisor to Virginia Gov. Ralph Northam, said. “Virginia’s state budget is based off of taxes from payroll and sales. When graduates spend less, less money enters into the state and local budgets that pays for education, public safety, workforce programs and transportation.”

The demand for a college degree has increased in past decades, leading to higher tuition costs. According to Business Insider, since the 1980s the cost of a four-year education at public institutions has risen 213 percent and 129 percent at private universities. “Virginia’s state budget shifts due to the economy has caused tuition prices to rise while state allocations or funding has decreased,” Dr. Healy said. “Because tuition is considered a ‘budget balancer’, legislators know that they can cut state funds to higher education because students and their parents will pay the difference. Colleges and universities have also added more services like mental health counselors, student centers and better dorms that have raised the costs of tuition and fees over the years.”

Over the past few decades, the value of a college degree has decreased. As more students earn college degrees, more job applicants can list one on their resumes. “Not all college degrees are created equal,” Dr. Healy said. “Virginia is different across the state. A college degree is almost a requirement in Northern Virginia (especially on government contracts) but a bonus for many jobs in the Hampton Roads/Richmond area.”

While students can apply for scholarship money from third-party organizations, colleges often offer extensive financial aid programs to help their students afford the cost of tuition. Many schools offer athletic and academic merit scholarships, and others will promise to meet 100% of the financial need demonstrated by their students, although the aid options are different at each school. “Scholarships can play a huge part in paying for college, but it all depends on how many the students apply for,” school counselor Ms. Zarin Kapadia said. “Many times students will focus on the large value scholarships, but there are many scholarships out there that may not be for as much, but can really add up and help with costs. The more scholarships you apply for the more money you might be qualified to get.”

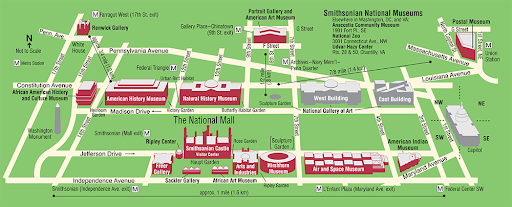

For over a decade, the state of Virginia has managed the Two-Year College Transfer Grant Program. Students who have completed their Associate’s Degree at a state community college with a grade point average (GPA) above a certain requirement could be eligible for guaranteed admission to select universities in the state. The schools, such as the University of Virginia or the College of William and Mary, set their own requirements for the minimum GPA. Students transferring may be eligible for the grant, which provides up to $3,000 towards tuition per year, with additional money for students pursuing degrees in certain fields. “The two-year college transfer grant was started to encourage students to finish the associates degree at the community college before transferring,” Dr. Healy said. “The majority of the students transfer before the associates degree is completed. These grants are based on family income so the state is encouraging families to look at more affordable options for higher education.”

Students transferring to certain schools in the program may be eligible for an additional $1,000 from the grant program. This decision was made in an effort to increase the rates of graduation within four years at the schools. “They lose students in the first two years so the transfer grant would add more students in the last two years of college,” Dr. Healy said.

A popular method of saving for college is a 529 plan, which is a specialized savings account that is not subject to federal taxes. In the state of Virginia, contributions to a 529 plan are tax-deductible. Virginia529 offers three different plans for families: Invest529 and CollegeAmerica are savings accounts, and the money in those can be used to pay for educational expenses like tuition, boarding or textbooks. The third plan, Prepaid529, allows families to pay the cost of a college semester in advance, although this money can only be used to cover tuition costs.. “Right off the bat we always say that ‘every dollar you save is a dollar you won’t have to borrow when college time comes,’” Ms. Devon Copeland, senior communications associate with Virginia529, said. “Money in 529 plans grow free from federal and state taxes, and are never taxed when the money is used for qualified higher education expenses. Plus, Virginia taxpayers can deduct up to $4,000 per account per year from their Virginia state individual income taxes.”

College, however, is not for everyone. Some students may not choose to pursue higher education. Trade jobs, where education often comes in the form of an apprenticeship, can pay well and offer a stable career. “In Virginia, we have a large number of people retiring in the trades and do not have a strong pipeline to fill these much needed jobs,” said Dr. Healy. “These jobs are in high demand and the pathways are debt-free. Many electricians and plumbers make six-figure salaries.”

The counseling office at the school is well-informed on the entire college search and admissions process. When students are selecting schools and looking at tuition costs, counselors are able to help provide insight on the various strategies that families can choose from. Ms. Elyse Catino, a college and career counselor at the school, said,. “Students and parents need to have a conversation as part of the college application process that discusses college finances. Who is paying for what and how much?”